Business planing and co-ordination. 1 This Act may be cited as the Income Tax Act 1967.

Chapter 5 Non Business Income Students

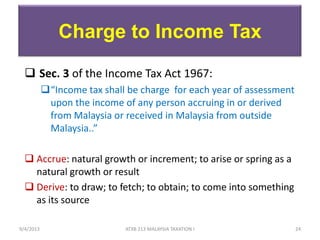

1 Subject to the provisions of sub-sections 2 3 and 4 for the assessment year commencing on the 1st day of April 1967 income-tax shall be charged at the rates specified in Part I of the First Schedule and in the cases to which Paragraphs A B C and D of that Part.

. 10 391969 321970 21971 411971 201972 571972. General management and administration. Briefly Section 140 of the ITA is the anti-tax avoidance provision where the Director-General of Inland Revenue DGIR is given.

The Collector to levy the tax in the same manner and with the like powers as other tax is leviable by him under this Act. The penalty would be 10 of the amount that is unpaid. View Full Act Amharc ar an Acht.

Non-chargeability to tax in respect of offshore business activity 3 C. Microsoft Word - Sec. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance.

Income Tax Act 1967. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Income Tax Act Chapter 2306 Commenced on 1 April 1967 This is the version of this document as it was at 14 March 2018 to 19 July 2018 Note.

Charge of income tax 3 A. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

4BWhere amount of exces in respect of a person is ascertained in accordance with subsection 504 of the Petroleum Income Tax Act 1967 or subsection 247A of the Real Property Gains Tax Act 1976 such excess shall be applied for the payment of tax which is due and payable including any amount of instalments which are due and payable by that. Classes of income on which tax. It is the tax payers responsibility to pay the tax instalment on the 15th of every month.

This version of the Act was revised and consolidated by the Law Development Commission of Zimbabwe Acts 51967 351967 301968 361969 s. Akta Cukai Pendapatan 1967 is a Malaysian law establishing the imposition of income tax. In the previous post accessible here I touched upon the relationship between Section 140 and Section 140A of the Income Tax Act 1967 ITA and how the lines may be blurred due to the newly enacted Section 1403a and 3b.

INCOME TAX ACT OF 1967 EXCERPT Act 281 of 1967 CHAPTER 11 206621 Nexus. 1 For the purposes of this Act an individual is resident in Malaysia for the basis year for a particular year of assessment if a he is in Malaysia in that basis year for a period or periods. 12242014 123057 PM.

Income Tax Act 1947. 7 ITA 1967 - Residence Individuals Author. Short title and commencement 2.

All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act 1890. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. View by Section Amharc de réir Ailt.

Procurement of raw materials components and finished products. Commenced on 1 April 1967 This is the version of this document as it was at 14 March 2018 to 19 July 2018 Note. 2 A reference in this Act to investment income net income or taxable income shall be read as a reference to investment income net income or taxable income as the case may be of the year of income.

Section 140 and Section 140A of the Income Tax Act 1967 are common provisions used by the Inland Revenue Board IRB in investigating transactions between relatedunrelated persons and in finding whether the arrangement is a tax avoidance schemeSection 140 empowers the Director General of Inland Revenue DGIR to disregard or vary a transaction. Income Tax Act 1967 - Free ebook download as PDF File pdf Text File txt or read book online for free. Actively solicits and physical presence defined.

Malaysian Income tax Act 1967. The Income Tax Act 1967 Malay. Penalty S 107 C 9 is for the unpaid tax amount instalment CP204 without a notification to the tax payer or tax agent.

Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. 1 Except as otherwise provided in this part a taxpayer has substantial nexus in this state and is subject to the tax imposed under this part if the taxpayer has a physical presence in this state for a. Recovery of penalties imposed under Part VIII 1 Special penalties imposed under subsection 1131 or 1141 shall be recoverable in the same way as fines imposed on conviction.

Aggregation and severance of. Where deduction of tax is authorised to be made out of any sums the deduction shall be made at such. The Assessment Act means the Income Tax Assessment Act 19361967.

Charge to tax in respect of provision for retirement or other benefits to directors and employees of bodies corporate. Approval of retirement benefits schemes. INCOME-TAX AND ANNUITY DEPOSITS FOR THE FINANCIAL YEAR 1967-68.

Table of Contents. 3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature. To consolidate the law relating to the taxation of incomes and donations.

Exemptions from charge under section 227. Long Title Part 1 PRELIMINARY. One of it falls under Section 107C9 Income Tax Act 1967.

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53125Recovery of penalties imposed under Part VIII. Income Tax Act Chapter 2306.

This version of the Act was revised and consolidated by the Law Development Commission of Zimbabwe. 1 Short title 2 Interpretation. The Income Tax Act 58 of 1962 aims.

The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income.

Income Tax Act 1967 As At 1st April 2017 Hobbies Toys Books Magazines Textbooks On Carousell

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

Books Kinokuniya Income Tax Act 1967 With Complete Regulations And Rules 6th Edition 9789670853161

Chapter 6 Business Income Students 1

Malaysian Income Tax Act 1967 Gabrieltrf

Income Tax Act 1967 Act 53 With Selected Regulation Rules Shopee Malaysia

Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 5th April 2018

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Income Tax Act 1967 Act 53 With Selected Regulations Rules Lazada

Income Tax Act 1967 Act 53 With Selected Regulations Rules Hobbies Toys Books Magazines Children S Books On Carousell

Mybuku Com Income Tax Act 1967 Act 53 9789678927703 Ilbs Lazada

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 7th Edition

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Librarika Income Tax Act 1967 Act 53